-

Acquisition, Disposition & Development

-

Asset &

Project Management -

Leasing

Expertise

EXPERTISE & TRACK RECORD

COVE TEAM

-

KEVIN HOO

Managing Partner

Kevin Hoo is the Managing Partner of Cove Property Group. Mr. Hoo has developed significant joint venture and capital partner relationships throughout his career and is responsible for the acquisition, financing and asset management of Cove's portfolio. Mr. Hoo has overseen in excess of $3 billion of direct real estate transactions, as well as development and capital projects throughout his career and has negotiated over one million square feet of leases across 90 separate transactions.

Prior to Cove, Mr. Hoo was a Managing Director at Savanna. While at Savanna, Mr. Hoo oversaw the acquisition, financing and asset management of nearly 1.8 million square feet through to successful investment exits, including 100 Wall Street, 245 & 249 West 17th Street, 21 Penn Plaza and 31 Penn Plaza. Before Savanna, Mr. Hoo was a Director at Tishman Speyer. Based in New York City, Mr. Hoo began in the Emerging Markets group (focused on China and India), initially managing acquisition and development opportunities and was subsequently granted oversight of design and construction elements in that role. Mr. Hoo later transitioned into the New York Acquisitions and Development group and finally the Commercial Leasing and Sales group, with a specific focus on Rockefeller Center and 200 Park Avenue. Prior to Tishman Speyer, Mr. Hoo was an Associate Director in the Real Estate Investment Banking Group at UBS AG in Sydney, Australia, where he was responsible for M&A and capital market transactions for REIT clients.

Mr. Hoo is a Vice Chair of the board of the Lower Manhattan Cultural Council and holds an MBA from the Kellogg School of Management at Northwestern University, as well as a Bachelor of Commerce (with honors) and Bachelor of Law (with honors) from the University of Queensland, Australia.

-

AMIT PATEL

Partner

Amit Patel is a Partner of Cove Property Group and serves as the firm’s Chief Operating Officer. Prior to Cove, Mr. Patel was at Barclays Investment Bank where he was responsible for leading strategic and operational projects initiatives for the executive team. In his role, Mr. Patel was based in both London and New York and oversaw the delivery of multiple initiatives, including the planning and execution of a $2 billion+ strategic change program, the largest in the bank's history, as well as the restructuring of Barclays operations in several European and Latin American markets.

Prior to Barclays, Mr. Patel was a Management Consultant at Roland Berger Strategy Consultants, where he was instrumental in the launch of their operations in Chicago, a large market for the firm currently. As a Management Consultant, Mr. Patel focused on global strategy development and operations improvement projects for organizations ranging in size from $100 million to $30 billion and has delivered in excess of $500 million in cost and revenue improvements. In addition to these roles, Mr. Patel also brings real estate experience through consulting project work involving master planning and tenant marketing for a large downtown development in the city of Calgary, Canada.

Before his time at Roland Berger, Mr. Patel held several technical roles as a mechanical engineer at Visteon Corporation, a former division of the Ford Motor Company.

Mr. Patel graduated with a Bachelor of Science and Master of Science in Mechanical Engineering from Carnegie Mellon University and the University of Michigan, respectively. He also holds an MBA from the Kellogg School of Management and a Master’s degree in Engineering Management from the McCormick School of Engineering at Northwestern University.

-

PAUL KING

Managing Director

Paul King is a Managing Director with Cove Property Group and leads design, construction and development activities. Prior to joining Cove, Mr. King held senior management positions at Skanska, Jones Lang LaSalle and Tishman Speyer where he had a leadership role in more than 40 million square feet of national and international commercial office and mixed use projects including ground-up and repositioning/renovation, high-rise urban development, and large infrastructure projects.

Mr. King’s experience includes over $30 billion of prominent projects completed over nearly 30 years with industry-leading firms in construction management, project management and real estate development. Mr. King’s unique core competencies span pre-development, project execution, risk management, operations support and technical services. He has worked with leading design firms such as Rogers Stirk Harbour + Partners, Herzog & de Meuron, Foster and Partners, Gensler, KPF, Legorreta + Legoretta, SOM, SHoP and Fogarty Finger Architects.

Mr. King earned a Master’s degree in Real Estate Development & Investment from New York University and a Bachelors Degree from Purdue University.

-

MARC ROSENBERG

Director

Marc Rosenberg is a Director with Cove Property Group and is responsible for the development and construction associated with real estate acquisitions and redevelopment projects.

Mr. Rosenberg has diverse experience across numerous market segments in New York City and has managed the construction of corporate interiors and special projects. He was responsible for the management of field staff and trade contractors from the preconstruction process, developing initial cost estimates through completion of all finish trades and project closeout.

Prior to joining Cove, Mr. Rosenberg was Senior Project Manager for Tishman Construction in New York City. There he was responsible for managing the preconstruction and construction of the multi-phased project to reposition the world headquarters of Citibank in New York City, specifically completing the construction of the Corporate Center facility for Citi executives and managing the preconstruction activities to create the Town Square.

As Account Manager for Icon Interiors, Mr. Rosenberg was responsible for the construction of corporate interiors for such companies as LinkedIn, Cleary Gottlieb Steen & Hamilton, The Durst Organization, Crain Communications and Two Sigma, contributing in upwards of 2 million square feet of commercial space to the New York City market.

Mr. Rosenberg holds a Bachelor of Architecture degree from the University of Miami and began his career in architecture and urban planning with Cooper Robertson and Partners developing urban infill solutions and private residential buildings throughout the United States.

-

MARIANNE PERRY

Executive Assistant

Marianne Perry is an Executive Assistant with Cove Property Group where she directs the administration of the office including human resources, accounting and compliance functions. In addition, Ms. Perry provides support to the Executive team and technical and operational assistance on Cove’s ongoing projects

Prior to joining Cove, Ms. Perry worked as an Executive Assistant to the Global CIO at Nomura, an Analyst to the CAO of Risk Technology at Citigroup and an Associate/Executive Assistant at Hycroft Advisors.

Ms. Perry earned her Bachelor of Arts at Parsons School of Design.

PORTFOLIO

441 Ninth Avenue | New York City

-

441 9th Ave Cove Property Group

-

ProEXR File Description

=Attributes=

cameraAperture (float): 36

cameraFarClip (float): 39370.1

cameraFarRange (float): 39370.1

cameraFov (float): 58.699

cameraNearClip (float): 0

cameraNearRange (float): 0

cameraProjection (int): 0

cameraTargetDistance (float): 200

cameraTransform (m44f): [{0.710433, -0.498382, 0.496891, 3538.12}, {0.703765, 0.503104, -0.501598, -155.489}, {-4.47035e-007, 0.706046, 0.708166, 3819.17}, {0, 0, 0, 1}]

channels (chlist)

compression (compression): Zip16

dataWindow (box2i): [0, 0, 4999, 4999]

displayWindow (box2i): [0, 0, 4999, 4999]

gamma (float): 1

lineOrder (lineOrder): Increasing Y

pixelAspectRatio (float): 1

screenWindowCenter (v2f): [0, 0]

screenWindowWidth (float): 1

tiles (tiledesc): [64, 64]

type (string): “tiledimage”

=Channels=

A (half)

B (half)

G (half)

R (half)

-

441 9th Ave August’19

-

441 9th Ave August’19

-

Hudson Commons

-

Hudson Commons

-

Hudson Commons

-

Hudson Commons

-

Hudson Commons

-

Hudson Commons

-

Hudson Commons

-

Hudson Commons

-

Hudson Commons

-

Hudson Commons

View Gallery

- 441 9th Ave Cove Property Group

- ProEXR File Description =Attributes= cameraAperture (float): 36 cameraFarClip (float): 39370.1 cameraFarRange (float): 39370.1 cameraFov (float): 58.699 cameraNearClip (float): 0 cameraNearRange (float): 0 cameraProjection (int): 0 cameraTargetDistance (float): 200 cameraTransform (m44f): [{0.710433, -0.498382, 0.496891, 3538.12}, {0.703765, 0.503104, -0.501598, -155.489}, {-4.47035e-007, 0.706046, 0.708166, 3819.17}, {0, 0, 0, 1}] channels (chlist) compression (compression): Zip16 dataWindow (box2i): [0, 0, 4999, 4999] displayWindow (box2i): [0, 0, 4999, 4999] gamma (float): 1 lineOrder (lineOrder): Increasing Y pixelAspectRatio (float): 1 screenWindowCenter (v2f): [0, 0] screenWindowWidth (float): 1 tiles (tiledesc): [64, 64] type (string): “tiledimage” =Channels= A (half) B (half) G (half) R (half)

- 441 9th Ave August’19

- 441 9th Ave August’19

- Hudson Commons

- Hudson Commons

- Hudson Commons

- Hudson Commons

- Hudson Commons

- Hudson Commons

- Hudson Commons

- Hudson Commons

- Hudson Commons

- Hudson Commons

441 Ninth Avenue was originally an 8-story building built as a warehouse in 1962 and later redeveloped as an office building in 1983. The property was acquired fee simple by Cove and its Joint Venture Partner in a marketed transaction in 2016 from Emblem Health, which owned and occupied the property prior to sale.

The existing building possesses a side core configuration with generous 50,000 RSF plates, 14’4″ slab-to-slab heights and natural light on four sides and an onsite parking garage.

The property is located between 34th and 35th Streets along the entire block front on 9th Avenue, at the heart of the Hudson Yards and Penn Station development. It benefits from superior transportation access, being equidistant between Penn Station and the new 7 train extension servicing Hudson Yards, as well as the Port Authority and the Lincoln Tunnel.

Cove’s business plan is to fully reposition the existing 8 story building and add an incremental 17 stories of rentable office floors above. The fully redeveloped Class A office property, named “Hudson Commons”, will total approximately 700,000 RSF across 25 stories, with floor plates ranging from 16,000 RSF to 50,000 RSF. The contemplated design will incorporate 14’-28’ ceiling heights, 8’3” vision glass in the podium, floor-to-ceiling vision glass in the tower and 14 terraces & balconies. The property is targeting LEED Gold and Wired Platinum certification and aims to offer a full package of amenities including tenant lounges, bike room, ample outdoor space and meeting room & conferencing facilities. The varied and flexible floor layouts are suited to a range of different sized tenants and industries including TAMI (Technology, Advertising, Media and Information), fashion, financial services and legal tenants.

For more information please visit: www.hudsoncommons.com

-

SUBMARKET

HUDSON YARDS -

YEAR BUILT

1962 -

STORIES

26 -

SQUARE FEET

700,000

PORTFOLIO

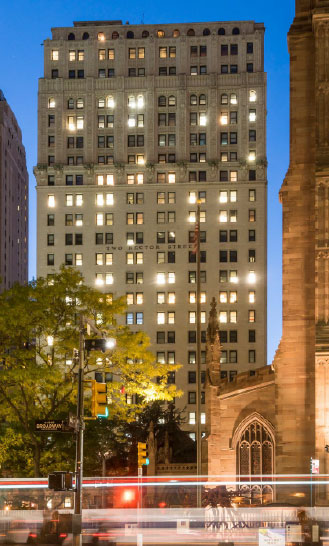

101 Greenwich Street | New York City

-

2 Rector Street

-

2 Rector Street

-

2 Rector Street

-

2 Rector Street

-

2 Rector Street

-

2 Rector Street

View Gallery

- 2 Rector Street

- 2 Rector Street

- 2 Rector Street

- 2 Rector Street

- 2 Rector Street

- 2 Rector Street

101 Greenwich Street, formerly 2 Rector Street, is a 26-story, Beaux Arts style building built in 1907 that will be transformed by Cove into a Class-A office building.

The property was acquired fee simple by Cove and the Multi-Employer Property Trust (MEPT), managed by Bentall Kennedy and NewTower Trust Company in a marketed transaction in 2016 from CIM Group and Kushner Companies— owners of the building since 2013.

The property is located in Manhattan’s Financial District on Rector Street between Greenwich Street and Trinity Place, two blocks south of the newly developed World Trade Center, with extensive retail and access to public transportation. It is ideally located to benefit from the growth that this submarket has experienced over the past decade. The unique physical characteristics of the property— namely its unique U-shaped floor plan with a side core configuration, 12’ slab-to-slab heights, sweeping views and light on six sides, beautiful terra-cotta facade with large windows, and relatively column-free and loft-like aesthetics— identify this building as a highly unique leasing opportunity in downtown Manhattan.

For more information visit: www.101Greenwich.com

-

SUBMARKET

FINANCIAL DISTRICT -

YEAR BUILT

1907 -

STORIES

26 -

SQUARE FEET

470,000+

IN THE NEWS

-

Top 5 LEED Platinum-Certified Buildings in the US

Top 5 LEED Platinum-Certified Buildings in the US A roundup of notable office buildings awarded LEED Platinum certification in 2020 through September. SEP252020 By Anca Gagiuc In honor of World Green Building Week, an annual campaign from the World Green Building Council, Commercial Property Executive reviewed notable office buildings that have achieved the prestigious LEED certification or recertification […]READ MORE >Top 5 LEED Platinum-Certified Buildings in the US

A roundup of notable office buildings awarded LEED Platinum certification in 2020 through September.In honor of World Green Building Week, an annual campaign from the World Green Building Council, Commercial Property Executive reviewed notable office buildings that have achieved the prestigious LEED certification or recertification in 2020 through September.

Based on an extensive list from the U.S. Green Building Council’s website, we filtered the data and selected projects that were awarded the LEED Platinum certification with published scorecards. Below is a list of five buildings ranked by size, with details about each asset that make them stand out in today’s world when everyone should #ActOnClimate.

Rank Project Address City State Points Achieved Certification Date Square Footage 1 388 Greenwich St. New York City New York 85 5/6/2020 2,222,976 2 707 Wilshire Blvd. Los Angeles California 80 2/10/2020 1,327,532 3 800 Fifth Ave. Seattle Washington 81 1/17/2020 1,000,485 4 250 Massachusetts Ave. NW Washington, D.C. District of Columbia 88 8/26/2020 595,442 5 441 Ninth Ave. New York City New York 81 4/8/2020 593,875 1. 388 GREENWICH ST., NEW YORK CITY

388 Greenwich St. Image via Google Street View The 2.2 million-square-foot skyscraper rises 39 stories high in lower Manhattan’s Tribeca neighborhood. In May this year, 388 Greenwich received LEED Platinum certification with a scorecard totaling 85 points.

The property was completed in 1988. In 2016, Citigroup acquired it from SL Green Realty for roughly $2 billion in a portfolio transaction that included the nine-story building at 390 Greenwich St., according to Yardi Matrix data. The deal was in fact a repurchase, as Citigroup had previously owned the building until 2007 when the firm sold it to a partnership between SL Green and Ivanhoe Cambridge. In 2018, the high-rise resurfaced with a new look, following substantial renovations conducted by Skidmore, Owings & Merrill and Tishman Construction Corp., with interior architecture by Gensler.

Today, the building flaunts a new facade covered in reflective glass panels, which flow on to the nine-story building at 390 Greenwich St., creating a seamless transition between the two structures. The smaller component boasts a rooftop terrace. The plaza in front of the entrance has been transformed, and includes a 3,500-square-foot open lawn, a water installation and more than 8,500 square feet of new plantings, including 28 trees. The renovated Citigroup headquarters features co-generation, smart lighting, improved air quality and enhanced water conservation. In 2017, the company announced its commitment to NYC’s Carbon Challenge, the initiative that aims to reduce greenhouse gas emissions in New York City by 30 percent in 10 years.

2. 707 WILSHIRE BLVD., LOS ANGELES

707 Wilshire Blvd. With its 62 stories, Aon Center is the third-tallest office tower in downtown Los Angeles and totals more than 1.3 million square feet. Designed by Charles Luckman in a modernist style, the remarkably slender building was completed in 1974. In 2014, Shorenstein Properties acquired it from Beacon Capital Partners for nearly $269 million, according to Yardi Matrix data.

In February 2020, the skyscraper was recertified to the LEED Platinum level with a scorecard of 80 points. The building has held a LEED certification since 2010 when it received the award at the Gold level. In 2015, it raised the bar for its sustainable features and was awarded LEED Platinum certification. Presently, it also holds an Energy Star certification with 85 score points.

To achieve USGBC’s highest level of certification, the building features large windows that allow natural light in, outdoor landscapes, bike parking, electric vehicle charging stations and easy access to public transportation. In addition, it is equipped with a building automation system and an advanced lighting control system with occupancy sensors, LED lighting in mechanical rooms, elevators and parking structures, and uses a demand response program for power management. It also repurposes the heat from the chiller to heat the building. Restrooms are equipped with motion-controlled, low-flow fixtures and faucet aerators, and a green cleaning program was implemented throughout the building. Special attention is paid to recycling paper, glass, aluminum, plastic, cardboard and electronic waste.

3. 800 FIFTH AVE., SEATTLE

800 Fifth Ave. The 42-story, 1 million-square-foot property located in the heart of the central business district received LEED Platinum recertification in January with a scorecard of 81 points. It has maintained this level of certification since 2015 when it was under Hines’ ownership. Last year, EQ Office paid more than $540 million for the asset.

Constructed in 1981 with 3D/International’s design, the building underwent upgrades in 2001 and 2016. The last revamp focused extensively on the lobby, which now features granite floors, marble walls with walnut accents and a new feature staircase with Wenge hardwood flooring. Furthermore, the central plant was upgraded and offers projected energy savings of 10 percent over the previous equipment. Additional sustainable amenities at the property include an outdoor plaza with a garden area and outdoor meeting spaces, premium bike storage and electric vehicle charging stations.

4. 250 MASSACHUSETTS AVE., WASHINGTON, D.C.

This nearly 600,000-square-foot, 12-story building is one of the five components of Property Group Partners’ $1.3 billion Capitol Crossing, a 2.2 million-square-foot revitalization project that kicked off in 2014 and is slated for completion in 2021. Skidmore, Owings & Merrill serves as the master planner, while Roche Dinkeloo is the architect. All five buildings are pursuing LEED Platinum certification, and 250 Massachusetts Ave. received it in August with 88 points.

The entire project is equipped with water cisterns that will capture and treat more than 90 percent of stormwater runoff and a cogeneration power unit, which means simultaneous production of electricity and heat. The developer will also install Eco Chimneys, which will clean car exhaust emitted from the below-grade parking garage and Interstate 395.

READ ALSO: Top 10 LEED-Certified Buildings in Washington, D.C.

5. 441 NINTH AVE., NEW YORK CITY

441 Ninth Ave. Hudson Commons, Cove Property Group’s 600,000-square-foot project at 441 Ninth Ave. in Hell’s Kitchen is an adaptive reuse development that integrates an eight-story warehouse with a new 17-story overbuild and features a Kohn Pedersen Fox design. In April, it received LEED Platinum certification with a scorecard of 81 points.

By transforming an existing structure, the design reduces the project’s environmental impact as it preserves embodied carbon. More than 85 percent of the existing building’s envelope and structural elements were reused, and the development team achieved an 80-percent diversion rate of construction and demolition debris. Moreover, regional and recycled content and FSC-certified wood and low-emitting materials were used, which also minimized the project’s carbon impact.

Especially convenient in health-related crises, the building uses opt-in facial recognition at the security turnstiles, and destination dispatch for the elevators is tied to each employee’s credentials, which means that tenants can access their premises without touching anything. Air quality is also improved through increased elevator cab ventilation, HEPA filters on all HVAC equipment and bipolar ionization for air purification in common areas.

Commercial Property Executive -

[INVNT GROUP]™ Secures New Global Headquarters In NYC In A Strategic Deal With Cove Property Group

The penthouse at 101 Greenwich – three times larger than the company’s existing flagship office – will accommodate its ongoing expansion Source: [INVNT GROUP]™ photo-release [INVNT GROUP] has secured a 12-year lease on the penthouse at 101 Greenwich in FiDi, Lower Manhattan. © Karen Fuchs NEW YORK, NY, Sept. 15, 2020 (GLOBE NEWSWIRE) — [INVNT GROUP], […]READ MORE >The penthouse at 101 Greenwich – three times larger than the company’s existing flagship office – will accommodate its ongoing expansion

[INVNT GROUP] has secured a 12-year lease on the penthouse at 101 Greenwich in FiDi, Lower Manhattan. © Karen FuchsNEW YORK, NY, Sept. 15, 2020 (GLOBE NEWSWIRE) — [INVNT GROUP], THE GLOBAL BRANDSTORY PROJECT™ has secured a 12-year lease on the 14,000 square-foot penthouse at 101 Greenwich Street in FiDi, Lower Manhattan.

The building, which underwent a $75 million renovation in 2017 under the supervision of landlords Cove Property Group and BentallGreenOak, features COVID-19 safe measures throughout, including touchless entry via Bluetooth and facial recognition enabled security turnstiles which integrate with a destination dispatch elevator system.

Within the new space team members can also expect touchless pantry and bathroom fixtures, improved air quality thanks to enhanced filtration and a dedicated outdoor air system, and many more smart features that enhance the employee experience while providing a COVID-19 safe work environment.

The space offers design-led elements fit for the GROUP’s four – and growing – creative-led agency brands, including 20-foot high ceilings, exposed brick, steel columns and sweeping views of the Hudson, all of which will be complemented by an interior from renowned New York City design practice, Fogarty Finger, who continue to design new pre-built and turnkey suites at 101 Greenwich.

The building itself is located in close proximity to public transport and FiDi’s array of restaurants, bars and fitness centers, ready for employees to enjoy when it is appropriate to do so.

The move, expected to take place in January 2021, was prompted by the GROUP’s ongoing expansion despite the pandemic, the companies’ collaborative approach, and their ability to reach a mutually beneficial agreement.

Commenting on the deal, Scott Cullather, President & CEO, [INVNT GROUP] says: “We engaged Cove Property Group in January as we were outgrowing our existing space in Soho, and this remains the case. Very early on in the pandemic we right sized the business, shifted our offering, and accelerated the launch of both [INVNT GROUP] and our creative-led culture consultancy, Meaning. We focused on looking ahead, not just surviving, and we’re continuing to grow and expand as a result of this.

“We can’t thank Cove Property Group enough for their professionalism and pro-active approach in providing us with a variety of options and solutions throughout this process. [INVNT GROUP] is thrilled to call the up-and-coming FiDi area home, and to move into our new, significantly larger space in January.”

Bill Concannon, Vice President, Cove Property Group added: “We renovated 101 Greenwich with the aim of breathing fresh new life into this iconic building, while honoring many aspects of its original structure. We envisioned a forward-thinking, global creative agency like [INVNT GROUP] to occupy the penthouse floor in particular, and couldn’t be happier to welcome them as tenants.

“This asset has been tracking positively during the pandemic, which is something we attribute to our commitment to wellness throughout the building both prior to and during COVID-19. Cove Property Group views the leasing success of 101 Greenwich as an indicator of New York City’s wider resilience, and we’re already seeing the market bounce back.”

About [INVNT GROUP]™

[INVNT GROUP] was established in 2020 with a vision to provide consistent, meaningful, well-articulated BrandStory across all platforms. Headed up by President and CEO, Scott Cullather, [INVNT GROUP], THE GLOBAL BRANDSTORY PROJECT™ represents a growing portfolio of complementary disciplines designed to help forward-thinking organizations everywhere, impact the audiences that matter, anywhere. The GROUP consists of modern brand strategy firm, FOLK HERO; creative-led culture consultancy, MEANING; branded content and digital marketing studio, HEVĒ, and the global live brand storytelling agency, INVNT™. For more information about [INVNT GROUP] visit: www.invntgroup.com/About Cove Property Group

Cove is a New York City-based owner, operator and developer of innovative institutional grade commercial real estate. Founded by Kevin Hoo, Thomas Farrell and Amit Patel, Cove’s principals have a combined 50 years of ownership, asset management and respected development expertise. Cove focuses on investment and redevelopment, as well as ground-up development, of key asset types including commercial office, retail, residential and industrial. For more information, please visit www.covepg.comAbout BentallGreenOak

BentallGreenOak is a leading, global real estate investment management advisor and a globally-recognized provider of real estate services. BentallGreenOak serves the interests of more than 750 institutional clients with expertise in the asset management of office, retail, industrial and multi-residential property across the globe. BentallGreenOak has offices in 24 cities across twelve countries with deep, local knowledge, experience, and extensive networks in the regions where we invest in and manage real estate assets on behalf of our clients. BentallGreenOak is a part of SLC Management, which is the institutional alternatives and traditional asset management business of Sun Life. For more information, please visit www.bentallgreenoak.comAbout Fogarty Finger

Fogarty Finger’s inventive and resourceful team provides sophisticated, contemporary designs that uphold the high aesthetic standards which our clients expect and appreciate. During the design process, we work one-on-one with our clients to exchange ideas and create visually striking environments which exceed their expectations. The firm has rapidly become a major New York City design practice, and has considerable experience delivering complete architecture and interior design packages for residential and commercial projects of every type and size. The design studio is both nimble and creative, providing fresh and elegant solutions to the most complex projects. The firm’s thorough and professional approach results in positive and lasting relationships with their clients. Head to www.fogartyfinger.comIntrado Globe Newswire -

Hudson Commons Achieves LEED Platinum Certification

The recently completed repositioning project was recognized for reusing an existing structure, thereby preserving embodied carbon and reducing its potential environmental impact. Hudson Commons is a renovation and repurposing of an existing 8-story warehouse on Manhattan’s west side to which was added a new, 17-story tower that elegantly rises from the podium to create optimal office […]READ MORE >The recently completed repositioning project was recognized for reusing an existing structure, thereby preserving embodied carbon and reducing its potential environmental impact.

Hudson Commons is a renovation and repurposing of an existing 8-story warehouse on Manhattan’s west side to which was added a new, 17-story tower that elegantly rises from the podium to create optimal office space for a variety of tenants.

Prioritizing sustainable practices, the design team minimized the need for new construction materials and the heavy equipment required for full demolition by fully reusing the existing building. Efficient construction waste management and the use of recycled content, as well as regional and low-emitting materials, also minimized the project’s carbon impact. In addition to these features, Hudson Commons is easily accessible from Penn Station, Port Authority, and the number 7 train at Hudson Yards, providing superior access to public transportation.

Situated at the gateway to the Hudson Yards submarket, Hudson Commons reflects the qualities of the preexisting site and scale of the originally industrial neighborhood. On the exterior, the podium’s lowered brick spandrels and new ribbon windows effuse greater natural light into the space. Within the interior’s base, a preexisting grid of fluted, concrete columns uphold their form and function. Moving up the tower’s floors, cellular beams and corrugated ceiling textures evoke the industrial quality of the podium. On the tower’s façade, a pattern of concave extrusions add depth to the glass grid, all the while harkening back to its surroundings through its duotone, white-grey detailing.

Developed by Cove Property Group, the Class-A building’s twenty-five rentable stories cater to the needs of diverse tenants, with nearly every level sporting private terraces or balconies, and the top floor combining its double-height space with a landscaped terrace. The tower’s side core configuration preserves city and river views, while an exposed stairway encourages daily use and communication between floors and contributes to the interior’s bright, open expanse. Floor-to-ceiling windows also enhance daylight coverage of each floor.

LEED (Leadership in Energy and Environmental Design) is the most widely used green building rating system in the world. Available for virtually all building types, LEED provides a framework for healthy, highly efficient, and cost-saving green buildings. LEED certification is a globally recognized symbol of sustainability achievement and leadership.

To learn more about KPF’s commitment to sustainability in design, and path to operational carbon neutrality, please click here.

KPF -

Longchamp- Fall 2020 Ready-To-Wear

By Laird BorelliI-Persson Longchamp creative director Sophie Delafontaine is Parisian to the core, but from her very first show in Manhattan (for spring 2019), she has clearly been completely at home with the American bigger-is-better mentality. The locations she’s found for each of her presentations have been spectacular, but it will be difficult indeed to […]READ MORE >Though we’re only days into New York Fashion Week, references to the 1970s are piling up. Like today, the Me Decade was one of political and economic unrest. It was also a time of advancement for women, who started entering the workplace in larger numbers. Fashionwise, the ’70s was the era of sportswear, separates, and, yes, culottes. (Though today they seem to belong to 2019, when Hedi Slimane showed them at Celine.) All three of these signatures were present in Longchamp’s rather bougie collection.

In keeping with its ’70s vibe, the strength of the fall lineup was in its individual pieces—i.e., the separates idea—as the full looks read a bit costumey. Longchamp is an accessories house first, and Delafontaine certainly delivered on the shoes and bags front. The boots with the silver ball hardware were newsy, but those with the stripe were timeless. The house’s most famous bag, Le Pliage, was taken to extremes, shrunk into a mini or blown up into grand proportions. The latter, in shiny patent, looked a bit like a portable John Chamberlain sculpture. Reimagined for the season were the Roseau model and what Delafontaine described as the house’s original It bag, which she’s dubbed the Longchamp 1980. All of these styles worked well with the midi length the creative director was running with for fall.

“Even if the beginning of the year is a little bit difficult everywhere, I am super optimistic,” said Delafontaine, who communicated that feeling through color. Of note was a light blue silk dress with a colorful geometric inset that resembled one of Josef Albers’s Homage to the Square paintings, as well as a deep green shearling coat. Making the grade were classic city pieces like the puffer coat and vest quilted with the Longchamp logo.COLLECTION

Look 1

Look 2

Look 3

Look 4

Look 5

Look 6

Look 7

Look 8

Look 9

Look 10

Look 11

Look 12

Look 13

Look 14

Look 15

Look 16

Look 17

Look 18

Look 19

Look 20

Look 21

Look 22

Look 23

Look 24

Look 25

Look 26

Look 27

Look 28

Look 29

Look 30

Look 31

Look 32

Look 33

Look 34

Look 35

Look 36

Look 37

Look 38

Look 39

Look 40

Look 41 Vogue Runway -

Front Row at Longchamp RTW Fall 2020

By WWD Staff on February 8, 2020 Front row at Longchamp RTW Fall 2020 Stéphane Feugère/WWD Photo : Stéphane Feugère/WWD Front row at Longchamp RTW Fall 2020 Kendall Jenner Photo : Stéphane Feugère/WWD Front row at Longchamp RTW Fall 2020 Coco Rocha Photo : Stéphane Feugère/WWD Front row at Longchamp RTW Fall 2020 Storm Reid Photo : Stéphane Feugère/WWD Front row at Longchamp RTW Fall 2020 […]READ MORE >

Front row at Longchamp RTW Fall 2020

Stéphane Feugère/WWD

WWD

-

Blackstone Provides $724M Refi for Cove Property Group’s Hudson Commons

By Cathy Cunningham Cove Property Group has closed a $724.2 million refinance for Hudson Commons, its trophy office redevelopment at 441 Ninth Avenue in Hudson Yards, Commercial Observer can first report. Blackstone Mortgage Trust provided the debt in a transaction arranged by Eastdil Secured’s Grant Frankel, Phil McKnight and Ethan Pond. “We are thrilled to provide senior mortgage financing on Hudson Commons, an outstanding property in Manhattan’s […]READ MORE >By Cathy Cunningham

Cove Property Group has closed a $724.2 million refinance for Hudson Commons, its trophy office redevelopment at 441 Ninth Avenue in Hudson Yards, Commercial Observer can first report.

Blackstone Mortgage Trust provided the debt in a transaction arranged by Eastdil Secured’s Grant Frankel, Phil McKnight and Ethan Pond.

“We are thrilled to provide senior mortgage financing on Hudson Commons, an outstanding property in Manhattan’s best performing submarket,” Steve Plavin, President and CEO of Blackstone Mortgage Trust, said in prepared remarks. “This transaction exemplifies BXMT’s differentiated ability to finance large scale, high quality real estate with strong sponsorship in core locations.”

Cove Property Group, along with Boston-based hedge fund The Baupost Group, purchased the property from EmblemHealth in 2016, paying $330 million. In 2017, the Cove-Baupost partnership secured a $479 million construction loan from Apollo Commercial Real Estate Finance and began a creative adaptive reuse redevelopment of the property.

The former structure comprised 423,000 square feet across eight stories, but Cove added an additional 17-story structure atop the building, expanding the total square footage to approximately 700,000 square feet. The Kohn Pedersen Fox-designed trophy asset features executive parking, premium bike storage, an 8,000-square-foot conferencing center and tenant lounge.

“From day one, we held true to our business plan of preserving a remarkable industrial building, while adding to it an integrated, efficient tower and thereby creating a best-in-class work environment that fosters collaboration, innovation and growth, all at the gateway to Manhattan’s newest center of business,”Cove Founder and Managing Partner Kevin Hoo said in a statement. “Cove and Baupost are extremely proud of the finished product, which we recently launched to market, and we look to welcome new tenants into the remaining tower floors. We are pleased that Blackstone appreciates the execution of our vision, and we are excited to be partners with them in this next chapter of Hudson Commons.

Anchored by Peloton, Hudson Commons is 65 percent leased today. Pelton occupies 336,000 square feet of the building as its corporate headquarters, Lyft leases 100,000 square feet and hedge fund Brevet Capital Management took 16,000 square feet in August on a 10-year lease. Within the newly-constructed tower floors, 213,000 square feet of office space remains, including the penthouse—which features a private rooftop garden and panoramic views across the city.

“With its sweeping views, hospitality-quality amenities and modern design features, Hudson Commons brings a unique appeal for creative and boutique office users,” Katie Keenan, Executive Vice President of Investments at Blackstone Mortgage Trust, said. “Cove and Baupost achieved top-notch execution on a complicated project, and we are excited to be financing this wonderful property.”

Commercial Observer -

Hudson Yards High-Rise Lands Key Tenant

By Gail Kalinoski Brevet Capital Management is set to move from its Park Avenue base to Cove Property Group’s Midtown Manhattan tower, joining Lyft and Peloton. Hudson Commons, Cove Property Group’s 25-story creative office property nearing completion in Manhattan’s Hudson Yards area, is now 65 percent leased. Brevet Capital Management, a specialty finance institutional investment manager, […]READ MORE >By Gail KalinoskiBrevet Capital Management is set to move from its Park Avenue base to Cove Property Group’s Midtown Manhattan tower, joining Lyft and Peloton.Commercial Property Executive -

Brevet Capital Management To Relocate Headquarters From Park Avenue To Cove Property Group's Hudson Commons

Brevet Will Move into 16,000 Square Feet at the new 441 Ninth Avenue NEW YORK, Aug. 6, 2019 /PRNewswire/ — Brevet Capital Management, the specialty finance institutional investment manager, and Cove Property Group announced today that Brevet signed a 16,178 rentable square foot lease at Cove’s Hudson Commons, located at 441 Ninth Avenue on the […]READ MORE >Brevet Will Move into 16,000 Square Feet at the new 441 Ninth Avenue

NEW YORK, Aug. 6, 2019 /PRNewswire/ — Brevet Capital Management, the specialty finance institutional investment manager, and Cove Property Group announced today that Brevet signed a 16,178 rentable square foot lease at Cove’s Hudson Commons, located at 441 Ninth Avenue on the West Side of Manhattan.

Cove, in partnership with The Baupost Group, purchased the property in December 2016 from Emblem Health. Over the past two years, Cove pursued an ambitious and creative adaptive reuse of the original 8-story warehouse combined with a new 17-story overbuild aimed at attracting a modern tenant base focused on growth, culture and sustainability. Brevet shares those values of excellence and innovation and looks forward to their expanded footprint in Manhattan’s newest neighborhood.

Brevet’s CEO Doug Monticciolo commented, “The open floor plan, abundant light and air, and industrial details will allow us to deepen our culture of collaboration and cross-pollinating information to create dynamic financial solutions and partnerships. Brevet will be able to originate new ideas and continue to grow more like a tech company, liberated from the restrictions of a traditional financial services set-up. The spaciousness of the office allows us to be a hub for our community, and host private events and talks with the experts and leading-edge thinkers that comprise Brevet’s cohort.”

The financial services firm is relocating from 230 Park Avenue and plans to move into its full-floor suite on the 20th level at 441 Ninth Avenue by the end of 2019. Brevet will join Peloton and Lyft at the 700,000 square foot project, bringing the property up to 65% leased prior to the project’s completion later this summer.

The new space for Brevet will feature 14′ slab heights, exposed castellated structural beams, nearly column-free workspace, views of Midtown and Lower Manhattan and an outdoor terrace. Given the building’s side core orientation, Brevet will benefit from a more efficient floor plate as well as floor-to-ceiling windows in the elevator lobby and bathrooms.

Amit Patel, Partner at Cove, added, “The genesis for the name ‘Hudson Commons’ stemmed from an early emphasis on creating a building that offers something unique and valuable to each tenant, including 50,000 square foot floor plates in the base of the building, boutique full-floor tenancy below 20,000 square feet in the tower, outdoor space and state-of-the-art technology. We are thrilled that one of the successes of this strategy is the emergence of a diverse tenant mix that will only strengthen Hudson Commons as a home for the world’s best companies and most talented workforce.”

“One of the attributes of Hudson Commons that resonated with Brevet is the amenity program that we are seamlessly integrating into the tenant experience,” said Colin Sullivan, Vice President at Cove. “We are rolling out best-in-class services to enhance employee happiness, engagement and productivity, which tenants are increasingly seeking to attract and retain top talent.” At Hudson Commons, tenants will be able to access a dedicated building concierge, manage amenity conference room reservations, submit service requests and control visitor access management, all from a new app-based platform. The Wired Score Platinum property will feature executive parking, premium bike storage, showers and a tenant lounge for touch-down space, conferencing, light fitness and building-wide events.

With the most recent signing of Brevet, only 213,00 rentable square of office space remains available in the newly constructed tower floors that range from 16,000 to 23,000 rentable square feet and feature private terraces on nearly all the floors. With the exception of Hudson Commons’ Penthouse which features 28 foot slab heights and a private rooftop garden, each tower floor boasts 14 foot slab heights with highly efficient side core layouts and 360 degree views.

The team of Stephen Siegel, Evan Haskell, Paul Haskin, James Ackerson and Ben Joseph from CBRE are the exclusive office leasing agents for the property.

Brevet was represented by Ben Friedland, Silvio Petriello and Sam Spillane, also from CBRE.

ABOUT BREVET CAPITAL MANAGEMENT

Headquartered in New York, Brevet Capital is a global specialty finance and solutions provider. Since inception, Brevet Capital has structured, executed and advised on $20 billion+ in client transactions. Focusing on opportunities related to the government sector, Brevet originates and structures customized financing solutions that achieve successful outcomes. Brevet Capital has a 20-year track record of partnering with U.S. state, federal, and international government agencies and contractors to provide unique financing solutions. www.brevetcapital.com

ABOUT COVE PROPERTY GROUP

Cove is a New York City-based owner, operator and developer of innovative institutional grade commercial real estate. Founded by Kevin Hoo, Thomas Farrell and Amit Patel, Cove’s team has a combined 50 years of ownership, asset management and respected development expertise. Cove focuses on investment and redevelopment, as well as ground-up development, of key asset types including commercial office, retail, residential and industrial. For more information, please visit www.covepg.com.

ABOUT THE BAUPOST GROUP

The Baupost Group is a Boston-based investment manager with a long-term, value-oriented approach. Since 1982, the firm has been thoughtfully stewarding and compounding capital on behalf of families, foundations and endowments, as well as employees who collectively are the firm’s largest client. Baupost manages roughly $28 billion with a broad and flexible charter, investing in a wide range of asset classes, including significant holdings in publicly traded debt and equity securities, private debt, real estate, and private equity. CEO and Portfolio Manager Seth Klarman has overseen Baupost’s investments from the company’s inception.

ABOUT CBRE GROUP, INC.

CBRE Group, Inc., a Fortune 500 and S&P 500 company headquartered in Los Angeles is the world’s largest commercial real estate services and investment firm (based on 2017 revenue). The company has more than 80,000 employees (excluding affiliates) and serves real estate investors and occupiers through approximately 450 offices (excluding affiliates) worldwide. CBRE offers a broad range of integrated services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services. Please visit our website at www.cbre.com.

SOURCE Cove Property Group

PR Newswire -

NKF Brokers Win Breakout Broker Award for Guiding Peloton to Hudson Commons

By Breather Given the enormous popularity of the cycling workout Peloton, it’s little surprise that the company has experienced explosive growth in both users and employees. When Peloton began searching for new office space in 2018, they required a space that was significantly larger than their existing HQ. So, they turned to Newmark Knight Frank […]READ MORE >By Breather

Given the enormous popularity of the cycling workout Peloton, it’s little surprise that the company has experienced explosive growth in both users and employees.

When Peloton began searching for new office space in 2018, they required a space that was significantly larger than their existing HQ.

So, they turned to Newmark Knight Frank brokers Ben Shapiro and Benjamin Birnbaum, whose deep understanding of the New York office and retail markets has guided Peloton since their inception.

The resulting deal finds Peloton preparing to move into seven floors at Hudson Commons, at 441 Ninth Avenue, and makes Shapiro and Birnbaum winners of the Breakout Broker Award presented by Breather, which recognizes brokers who went above and beyond the norm to close a challenging or unique deal.

Birnbaum, a vice chairman and retail specialist at Newmark Knight Frank, one of the world’s leading commercial real estate advisory firms, began his career with the firm in 2007. In that time, he’s completed over a billion dollars’ worth of transactions, including guiding the retail roll-outs of Watches of Switzerland, CityMD and Peloton.

Birnbaum met Peloton founder and CEO John Foley when the company was still just an idea.

“I first had the pleasure of working with John as he was building the company,” said Birnbaum. “Fast forward a few months, we helped him to sign their first location for their current studio and production facility at 140 West 23rd Street.”

After helping the new company find its 5,000-square-foot studio space, NKF dove in to identify the ideal office space for them as well.

For this, NKF’s Executive Managing Director Ben Shapiro took over. Shapiro has been with NKF since 2013 (and has been a good friend of Birnbaum’s since college). He has worked on behalf of institutions such as The Blackstone Group, Trinity Church and The New York Times Company, among others.

Shapiro secured a 9,661-square-foot office space for Peloton at 158 West 27th Street in 2014. The company was growing so fast, though, that they needed a much larger space just one year later. They continued to grow and quickly saw themselves leasing more than 64,000 square feet at 125 West 25th Street. At this time, Shapiro and Birnbaum also secured Peloton a retail space at 5 Manhattan West for their new super studio (for this transaction they were awarded The Most Ingenious Retail Deal of the Year award from the Real Estate Board of New York).

In early 2018, Peloton’s growth showed no sign of slowing down and they were in need of their biggest space yet. Shapiro and Birnbaum, in collaboration with NKF’s Workplace Strategy & Human Experience team led by Tamar Moy, engaged Peloton’s leadership and employees to learn how to best position their growing headcount, work processes and overall workplace experience, which would ultimately yield an office setting that would occupy over 300,000 square feet.

“They were outgrowing their existing footprint,” said Shapiro. “We understood which departments their head count growth was coming from, the time frame for that growth and what business decisions were driving demand. John Foley has a vision about what type of environment he wants to create. He wants to create the best office space in Manhattan to attract and retain top talent. It was our job, under the leadership of Peloton VP David Deason, to execute on that vision.”

Birnbaum and Shapiro knew early on that Hudson Commons would be a top candidate for the new space.

Originally an eight-story building, Hudson Commons is currently undergoing extensive renovations to its existing floors and adding an 18-story extension, including 300,000 square feet of new office space, that will position it as one of the city’s most desirable office locations.

Once completed, Hudson Commons will have terraces on most levels, 14-foot slab heights, floor-to-ceiling windows and a bike room with showers, something few New York office buildings can claim.

Aside from its convenient proximity to the company’s 5 Manhattan West location, Hudson Commons appealed to Peloton for several reasons.

“Because the building is an eight-story structure with a new 18-story overbuild,” added Shapiro, “you have this confluence of new and old architecture and indoor-outdoor environment highlighted by the ninth floor terrace, which will be the largest outdoor space in Midtown.”

While the renovation will provide Peloton with a world-class home, preparing to move a client during a major building renovation presented unique challenges.

“The renovations made the lease negotiation a bit more complicated,” Birnbaum said. “There are outside dates and construction challenges you have to navigate, and it made the legal process more challenging. However, once we got into discussions, we were able to quickly get comfortable with the construction timeline, as it progressed at a rapid pace. Kevin Hoo and Tom Farrell of Cove Property Group are consummate professionals with an impressive track record.”

In the end, Peloton signed a lease for 313,000 square feet at Hudson Commons, taking the fourth through 10th floors plus basement space. Renovations are expected to be completed later this summer, and the company will move in during the third quarter of 2020.

As they prepare for the big move, the company couldn’t be more pleased with the results.

“We are tremendously excited to be developing our new headquarters at Hudson Commons.” said David Deason, vice president of real estate at Peloton. “From the initial search and review of the NYC market through LOI and Lease negotiations, Ben Shapiro, Ben Birnbaum and the entire NKF team delivered tremendous guidance and expertise in navigating the transaction. The NKF team approached every aspect of this effort from a position of ownership and partnership, which provided fantastic results.”

Birnbaum and Shapiro see the success as indicative of NKF’s versatility: the company’s ability to service its clients across diverse areas of business.

“NKF cultivates entrepreneurship and collaboration to drive client service. What’s important is the ability Ben and I have to leverage the NKF platform for the betterment of our clients,” Birnbaum said. “We are proud of the fact that this started out as a retail assignment, and evolved into a much bigger account we were able to service across multiple verticals within our firm.”

Commercial Observer -

Under Construction: Hudson Commons at 441 Ninth Avenue

By Rebecca Baird-Remba In New York City, developers usually knock down old buildings to construct new ones. Sometimes, however, owners use a little zoning magic to dramatically expand an older structure into a much larger tower. Such is the case at 441 Ninth Avenue, an eight-story 1960s warehouse that’s getting an 18-story extension between West […]READ MORE >In New York City, developers usually knock down old buildings to construct new ones. Sometimes, however, owners use a little zoning magic to dramatically expand an older structure into a much larger tower.

Such is the case at 441 Ninth Avenue, an eight-story 1960s warehouse that’s getting an 18-story extension between West 34th and West 35th Streets next to Hudson Yards. Cove Property Group is developing the 700,000-square-foot building, two-thirds of which has already been leased by Lyft and Peloton. It has also been rebranded Hudson Commons.

Developer Harry Macklowe converted the 400,000-square-foot gray brick warehouse to offices in 1983 before selling it to EmblemHealth a decade later. The insurance company owned and operated the property until it sold to Cove in 2016 for $330 million. Now the development firm is adding 300,000 square feet of new office space to the property, which is expected to be complete in August. The original building has been completely overhauled, with a new lobby, mechanicals, HVAC system, elevators and amenity spaces.

Although the site came with some air rights, Cove was able to pull off the expansion by purchasing additional floor area from the Hudson Yards District Improvement Fund, a pool of air rights controlled by the city. Its construction team was able to construct a 420-foot-tall building by driving the steel shafts of the new structure through the columns of the old warehouse.

“We added 18 stories to this building but didn’t add a single column,” said Thomas Farrell, one of the partners at Cove. “That was part of our acquisition strategy: minimize the deconstruction of this building and find a way to add the new floor area in a super elegant, structural way.”

The extension creates terraces on nearly every new floor and features floor-to-ceiling windows, even in the bathrooms. The structure is set back from the original building, creating a large wrap-around terrace on the ninth floor, and gradual setbacks above create more outdoor space on the upper floors.

The new lobby, which was carved out of a loading dock, will have polished concrete floors and ceilings, walls and a reception desk made of white Portuguese limestone, a wall of black anodized aluminum surrounding the elevators, and a 20-foot-long, horizontal chandelier made of glass and translucent marble. The entryway will also feature the large, mushroom cap columns that run through the entire building.

“We’re paying homage to the industrial, factory aesthetic, and we’re trying to make sure the lobby materials will stand the test of time,” explained Kevin Hoo, the managing partner of Cove.

After the security turn styles, there will be a seating area and coffee bar that’s being elevated a few steps above the rest of the lobby and separated with a short glass divider. Behind the seats will be flexible, open amenity spaces that can host all-hands meetings, fitness classes or parties. In addition, tenants will have access to a bike room with showers, an exciting and still unusual amenity for office buildings. Kohn Pedersen Fox handled the design of the lobby and the overall project, while Gensler is doing the rest of the interiors.

Commercial Observer -

Hudson Yards Officially Opens in NYC

By Holly Dutton The new neighborhood on the far west side of Manhattan is the largest private real estate development in U.S. history. Nearly ten years after the New York City Council approved the Related Companies’ multi-billion plan to rezone and develop a 28-acre site on the far west side of Manhattan, the first phase of […]READ MORE >By Holly Dutton

The new neighborhood on the far west side of Manhattan is the largest private real estate development in U.S. history.

Nearly ten years after the New York City Council approved the Related Companies’ multi-billion plan to rezone and develop a 28-acre site on the far west side of Manhattan, the first phase of the new neighborhood is finally open to the public.

Hudson Yards, which spans from 30th to 34th Streets between 10th and 11th Avenues and 30th to 33rd Streets between 11th and 12th Avenues, will include more than 18 million square feet of commercial and residential space, more than 100 shops and restaurants and 14 acres of open space.

Hudson Yards

Related and Oxford Properties Group held an invite-only kickoff gala March 14, the night before the Shops & Restaurants portion of the $16 billion project debuted to the public. The one-million-square-foot retail center features more than 100 retailers from luxury to fast fashion, several online-only brands opening up their first brick-and-mortar space and cultural exhibitions.

Dining options are spread across the six levels of the retail center and range from fast casual to fine dining restaurants, curated by high-profile chef Thomas Keller and Kenneth Himmel.

“The culinary creativity and diverse retail experiences at The Shops & Restaurants at Hudson Yards showcase some of the most innovative and exciting concepts in shopping and dining today,” said Dean Shapiro, head of U.S. Property Development for Oxford Properties Group, in prepared remarks. “We truly believe we have assembled a collection that will delight New Yorkers and visitors alike.”

NEIGHBORHOOD RISING

Among the highlights of the openings is Vessel, the public art installation designed by Thomas Heatherwick that is a centerpiece of Hudson Yards. Visitors can pay to walk up nearly one mile of 154 interconnected staircases to reach the top of the sculpture.

New office towers at the site include 10 Hudson Yards, which is home to L’Oreal USA, SAP and Tapestry, among other tenants, 30 Hudson Yards, which has already signed WarnerMedia to 1.5 million square feet of space, 50 Hudson Yards, which will be anchored by BlackRock and 55 Hudson Yards, which has signed several law firms including most recently, Boies Schiller Flexner.

In addition to the office properties, four residential towers with a combined 4,000 units are rising at the site—two of which are condominiums and two of which are rentals. Ten percent of the residential units are designated affordable.

Last July, Related and Oxford announced that 30 Hudson Yards, the second-tallest building in New York City, topped out at 1,296 feet. The 90-story tower boasts an observation deck that is the tallest in the Western Hemisphere at 1,100 feet, extending 65 feet from the building. In February, ride share giant Lyft inked a 100,638-square-foot lease at Cove Property Group’s creative office property Hudson Commons, located within the Hudson Yards district.

Image courtesy of Hudson Yards

Commercial Property Executive -

Cove Property Group’s Bet on Penn Plaza Pays Off as its Hudson Commons Project Adds Another Anchor Tenant

By Diana Bell As part of its gut repositioning of Hudson Commons at 441 Ninth Ave., developer Cove Property Group is creating a penthouse unit with trading floor. Image: Cove Property Group Lyft, a popular ridehailing app rivaled only by Uber, is the newest technology tenant to sign on for new headquarters space at Hudson Commons, […]READ MORE >By

As part of its gut repositioning of Hudson Commons at 441 Ninth Ave., developer Cove Property Group is creating a penthouse unit with trading floor. Image: Cove Property Group Lyft, a popular ridehailing app rivaled only by Uber, is the newest technology tenant to sign on for new headquarters space at Hudson Commons, one of the major creative office repositionings that is redefining the Penn Plaza neighborhood in Manhattan’s Midtown West.

Lyft’s new headquarters is expected to span 100,638 square feet, and brings the Hudson Commons property at 441 Ninth Ave. to 63 percent occupancy ahead of its opening this summer. The deal follows a November lease agreement with fitness technology brand Peloton for a 312,000-square-foot headquarters that effectively anchors the 700,000-square-foot property.

As more than 10 million square feet of brand new, high-end office space rises within the Hudson Yards district on the western end of Manhattan, a number of Manhattan office landlords have jumped into redevelopment work within the adjacent Penn Plaza neighborhood, often citing Penn Plaza as one of the next submarkets to benefit from a new and growing workforce seeking quality office space with convenient transportation links.

“The Far West Side is at the forefront of the mixed-use community style developments that have changed the office landscape of Manhattan,” said Edward Son, a market analyst covering the New York City market for CoStar Market Analytics. “There is approximately 10.6 million square feet of office space currently under construction and another 3.8 million square feet proposed and waiting to secure an anchor tenant. The total of 14.4 million square feet will be a massive boost in the already existing inventory of 5.1 million square feet.”

When asked about the repositioning of older buildings in Midtown West to accommodate demand for new space, Cushman & Wakefield Managing Principal Lou D’Avanzo said that the market for those kinds of opportunities has strengthened.

“Landlords will look for those opportunities – from an investment side of this market, where can they purchase and reposition a building and they can price at one level of rent structure,” he noted. D’Avanzo was not involved in the Lyft transaction but is active in Manhattan office leasing activity and trends.

Cove Property Group, with its Hudson Commons project at 441 Ninth Ave., is one such landlord bringing new space to market to answer this demand. In December 2016, Cove teamed with hedge fund manager Baupost Group to acquire the 10-story building, a warehouse built in the early 1960s, from insurance company Emblem Health. Within a year, the developers had vacated the building and secured a $479 million construction loan to gut renovate and build an additional 18 stories atop the property, tapping architectural firm Kohn Penderson Fox to lead the redesign.

A rendering of Hudson Commons at 441 Ninth Ave., which is in the final stages of development and expected complete this summer. Image: Cove Property Group Cove is not the only Manhattan office landlord tackling large developments in the area. Vornado, for instance, is in the process of redeveloping more than 4 million square feet of its office holdings within Penn Plaza, including work on Moynihan Train Hall, Penn1 and Penn2. It will roll over $1 billion in proceeds from condominium sales at its luxury supertall tower, 220 Central Park South, to fund these endeavors.

“To a large extent, the concentration of new development by world-class developers in the Hudson Yards, as well as Penn Plaza neighborhood, will be a global advertisement for New York City for many years to come,” Cove Property Group Managing Principal Kevin Hoo said in an interview with CoStar News.

According to Son, when it comes to new office construction, the Penn Plaza / Garment District submarket leads all other submarkets in the United States, with approximately 12 million square of office space currently being built.

“The majority of the total is driven from the ultra-luxurious high-rise towers at the Far West Side, where developers such as Related, Brookfield, Tishman Speyer, and Moinian Group have office projects ranging from 1.6 million to 2.9 million square feet,” Son said. “As the new premium towers continue to receive strong demand with many of the city’s prominent occupants relocating to the area, investors have looked for value-add opportunities in the surrounding area.”

When considering the potential of 441 Ninth Ave., Hoo said that, “Proximity to Penn Station and the Lincoln Tunnel was a key driver in our thinking. That, coupled with diversity of offering that we could deliver in floor plate sizes and aesthetic was a unique combination that we felt compelling” from an investment perspective. Hoo added, “The ability to deliver such a multi-faceted office building through a complicated overbuild of an existing podium with 18 floors of new construction, all in less time than it would have taken us to tear down and build all-new, was a challenge too good to refuse!”

By retaining the majority of the building’s bottom structure and adding new construction above, Cove was able to support open floor plates that range in size from 16,000 to 50,000 square feet each.

“We saw an opportunity to create a unique property that attracted as wide a tenant audience as possible,” Hoo said, especially from those that value “efficient” floor space. Besides the interest from technology companies like Lyft and Peloton, the building is getting attention from more traditional financial services tenants, according to Hoo.

“We immediately identified unique aspects of the existing structure and its foundations which allowed us to essentially triple its height in an economical and efficient way,” Cove partner Thomas Farrell said in a statement. “Working with architect Kohn Pedersen Fox, our structural engineer WSP and [construction manager] Pavarini McGovern, we came up with an elegant solution to insert a core for the new tower within the existing column grid so as to harmonize the new and old in a seamless manner.”

Steve Siegel, chairman of Global Brokerage at CBRE, said in a statement that, “Hudson Commons is one of the most innovative development projects that we have been associated with. Cove and Baupost recognized the demand for both upgraded authentic and efficient space by the expanding technology tenant base along with the focus on high-end newly constructed space by the more traditional tenant.”

Siegel works on the CBRE team representing the landlord in leasing the tower.

Cove declined to comment on the project’s total anticipated development cost. The landlord is offering to new tenants a choice of industrial or modern interior finishes in retrofitting the interior space.

“We are finding that tenants today value aspirational working environments. Given the value placed on experiences within the environments they live and work in. We wanted to create an office building that would help tenants continue to attract and retain best in-class talent,” Hoo said.

Cove has designed the seventh floor of the building to accommodate technology tenants. Image: Cove Property Group “The layouts of the floors have been designed to be as efficient as possible, while maintaining the flexibility to be collaborative, office intensive or a mix of both,” he said. “The 14-foot ceiling heights, floor-to-ceiling glass in the tower and nearly column-free space allow us to curate this environment. We also valued the authenticity of the existing building and used a wood-form concrete core and long-span castellated beams throughout the new floors to retain the industrial feel.”

Tenant amenities include dedicated outdoor terraces on 14 of the 18 new floors, bike storage and showers, as well as a tenant lounge and conference center on the ground floor, which offers tenants the ability to hold town halls or ad hoc meetings.

Cove has also invested into “mobile app-based, tenant-facing technology,” to enable building entry via facial recognition, on-demand amenity booking and an interface to communicate service requests with management. The property is on track to achieve WiredScore platinum and LEED platinum certifications, and has had a Distributed Antenna System to maximize wireless connectivity.

About 235,000 square feet remains available for lease at Hudson Commons.

Hoo said that leasing progress at the building “tells volumes as to the attractiveness of redeveloped and new development on the far West Side” of Manhattan. “But this is only the start,” Hoo explained, “as the influx of new office tenancy and the vibrancy of the residential and retail tenancies that will accompany it will also develop its own identity in time and further improve the neighborhood. We feel strongly that the diversity of Hudson Commons’ design and its proximity to Penn Station will allow us to benefit from this trend over the long term.”

For the Record: A CBRE team of James Ackerson, Evan Haskell, Paul Haskin, Ben Joseph and Stephen Siegel work as exclusive office leasing agents for the property. Justin Haber and Steven Rotter of Jones Lang LaSalle acted on behalf of Lyft in lease negotiations.

CoStar -

Lyft Signs Lease With Cove Property Group

By Cove Property Group Ride-hailing company signs 100,638 rsf lease at new 441 Ninth Avenue Cove Property Group (“Cove”) announced today the signing of a 100,638 rentable square foot lease by Lyft, Inc at Hudson Commons, a 28-story creatively repositioned office tower located in Manhattan at 441 Ninth Avenue and 34th Street. The building’s location […]READ MORE >By Cove Property GroupRide-hailing company signs 100,638 rsf lease at new 441 Ninth AvenueCove Property Group (“Cove”) announced today the signing of a 100,638 rentable square foot lease by Lyft, Inc at Hudson Commons, a 28-story creatively repositioned office tower located in Manhattan at 441 Ninth Avenue and 34th Street. The building’s location at the gateway of Hudson Yards and its immediate proximity to the ongoing redevelopment of the Moynihan transportation hub and Penn Station has made it an attractive destination for global brands such as Lyft and Peloton, Inc., which signed a 312,200 rentable square foot lease in November 2018. Now 63% pre-leased, the building will be delivered in the summer of 2019.

Cove, in partnership with the Baupost Group, purchased the property in December 2016 from Emblem Health. Since vacating the property in its entirety in April 2016, Cove has embarked on an ambitious repositioning aimed at capturing the imaginations of a wider tenant base that continues to be attracted to the Hudson Yards district.

“The neighborhood’s transformation is exciting and ongoing. In surveying the surrounding developments, we saw an opportunity to respect the beautiful 1962 warehouse building’s heritage and add significant square footage above it, rather than tear it down. The aim was to provide a combination of large and boutique floor plates ranging from 50,000 RSF to 16,000 RSF, that paired the factory type feel and aesthetic in the base with new, efficient construction,” said Kevin Hoo, Managing Partner at Cove. “At Hudson Commons, each floor possesses an individuality created through the combination of size, layout or outdoor space that disrupts the traditional vertical rent/view/experience hierarchy of an office building.”

To allow tenants to continue to attract and retain top new talent, Cove has created the workplace of the future with a strong emphasis on the user experience. Amit Patel, a partner at Cove, has overseen the implementation of new technology into Cove’s properties, seeking to leverage best-in-class methodologies which will be WiredScore Platinum certified.

“The infusion of technology and the amenitization of the office environment is here to stay. Our tenants demand quicker response times and a mode of operation that mimics their living environments, whether it be through app-based zoned climate controls within their spaces, real time amenity/event reservations, seamless visitor management or even facial recognition technology at the turnstiles to expedite secured access to the building,” said Mr. Patel.

The complexity of the redevelopment itself is also a significant feature and strength of Hudson Commons. Thomas Farrell, a partner at Cove, has an extensive track record of global development through his previous tenure at Tishman Speyer where he was a Senior Managing Director and Partner responsible for its global design and construction activities. There, he oversaw the development management and construction of global iconic towers and was involved in five similar overbuild projects.

“This is my sixth such project and we immediately identified unique aspects of the existing structure and its foundations which allowed us to essentially triple its height in an economical and efficient way.” Mr. Farrell said. “Working with architect Kohn Pedersen Fox, our structural engineer WSP and CM Pavarini McGovern we came up with an elegant solution to insert a core for the new tower within the existing column grid so as to harmonize the new and old in a seamless manner for which we have already won awards for structural ingenuity.” The combination of old and new has allowed the building to file for LEED Platinum certification in part because “there is nothing more sustainable than reusing an existing building.”

With the signing of both the Peloton and Lyft leases, only 253,000 rentable square of office space remains available in the newly constructed tower floors that range from 16,000 to 23,000 rentable square feet and feature private terraces on nearly all the floors. With the exception of its Penthouse which features 28 foot ceiling heights and a private rooftop garden, each tower floor boasts 14 foot ceiling heights with highly efficient side core layouts and 360 degree views.

The team of Stephen Siegel, Evan Haskell, Paul Haskin, James Ackerson and Ben Joseph from CBRE are the exclusive office leasing agents for the property.

Steve Siegel, Chairman of Global Brokerage at CBRE added, “Hudson Commons is one of the most innovative development projects that we have been associated with. Cove and Baupost recognized the demand for both upgraded authentic and efficient space by the expanding technology tenant base along with the focus on high-end newly constructed space by the more traditional tenant. Their design and execution of Hudson Commons is an extraordinary accomplishment in that they have created a building that meets both of these demands. The leasing success it has earned to date coupled with the strong, ongoing interest puts paid to their vision. We are excited to continue on with the leasing of the tower floors which are all highly desirable new construction floors with panoramic views.”

Hudson Commons has also commenced its retail leasing program which is offering 15,000 square feet of retail space at grade, along each of 34th and 35th Streets as well as 9th Avenue. Featuring soaring 19 foot ceilings and beautiful mushroom capital columns from the original building, Cove aims to attract a broad mix of creative tenants that will activate the corridor and act as amenities to its tenant base. Winick’s Steven Baker and Daniyel Cohen are the exclusive retail leasing agents.

Lyft was represented by Steven Rotter and Justin Haber at JLL.

ABOUT COVE PROPERTY GROUP

Cove is a New York City-based owner, operator and developer of innovative institutional grade commercial real estate. Founded by Kevin Hoo, Tom Farrell and Amit Patel, Cove’s team has a combined 50 years of ownership, asset management and respected development expertise. Cove focuses on investment and redevelopment, as well as ground-up development, of key asset types including commercial office, retail, residential and industrial. For more information, please visit www.covepg.com.ABOUT THE BAUPOST GROUP

The Baupost Group, L.L.C. (“Baupost”) is a Boston-based, value-oriented, open-mandate investment organization whose goal is to invest capital to achieve attractive, risk-adjusted returns over an extended period of time. The firm is an experienced investor in a wide range of securities and asset classes, including real estate and private equity holdings.ABOUT CBRE GROUP, INC.

CBRE Group, Inc., a Fortune 500 and S&P 500 company headquartered in Los Angeles is the world’s largest commercial real estate services and investment firm (based on 2017 revenue). The company has more than 80,000 employees (excluding affiliates) and serves real estate investors and occupiers through approximately 450 offices (excluding affiliates) worldwide. CBRE offers a broad range of integrated services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services. Please visit our website at www.cbre.com.ABOUT WINICK REALTY GROUP

Established in 1982, Winick Realty Group LLC is one of New York’s prominent real estate firms specializing in retail leasing, investment sales and advisory services. Over the years, Winick Realty has served a broad range of domestic and global clients, with a strong emphasis on long-term representation and expansion and growth strategies. Winick Realty Group LLC is highly recognized as a forerunner in the retail real estate market. For more information, please visit the company website www.winick.com.PR Newswire -

Lyft signs 100K sf lease at Cove Property’s 441 Ninth Avenue

By David Jeans A rendering of 441 Ninth Avenue with the Lyft mustache (Credit: Cove and Wikipedia) Ride-share behemoth Lyft has signed a 100,000 square foot lease at the Hudson Commons new development on the Far West Side. The San Francisco-based firm will move into Cove Property Group’s 700,000-square-foot new development building at 441 Ninth […]READ MORE >By David Jeans

A rendering of 441 Ninth Avenue with the Lyft mustache (Credit: Cove and Wikipedia)